With a recession in the picture, companies of all sizes are identifying their strengths and pivoting to more effective strategies to sustain their business. Looking back at the start of 2022 – a phase known as The Great Resignation, marked by employees leaving their jobs en masse after the Covid-19 pandemic – would one have expected the regional ecosystem to be in this position today?

Back in July, Glints co-founder and CEO Oswald Yeo told Tech Crunch that Singapore is the first to be hit by hiring freezes and layoffs – after all, it is the headquarters for many regional companies, and the most mature startup economy in Southeast Asia. Known as The Great Belt Tightening, it is the latest in a slew of pandemic-triggered hiring trends – and is considered a market correction by most parties.

“I think what we have seen is that there has been a lot of capital being pumped into the tech industry over the past two to three years in a major bull run. With that, we had a lot of companies that have also expanded rapidly,” he explained. Towards the end of 2022, these corrective measures have expanded to implement cost-saving measures to protect resources.

With that said, what lessons should we take into the new year? Through our growing network of employers and talent, we were able to gain insights into hiring and industry trends over the past year.

This analysis primarily highlights data aggregated from postings, companies, and candidates from the Glints job portal in 2021 and 2022. Supporting it is Glints proprietary findings from tech talent hiring and compensation surveys, carried out on startup founders and talent in Singapore, Indonesia, and Malaysia within the same time period.

In this context, let’s take a closer look at three major hiring trends of 2022 – and what employers should brace for in 2023.

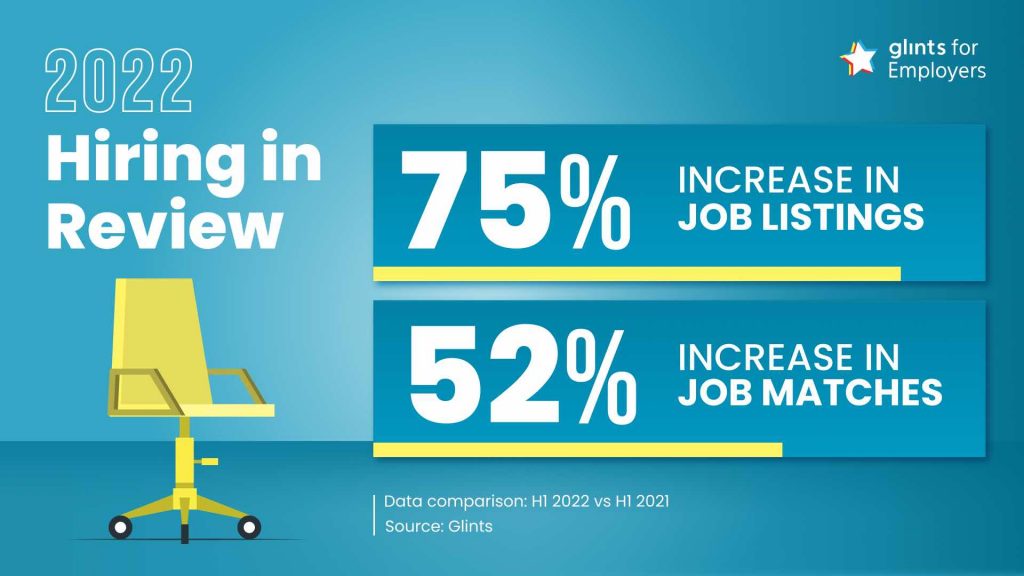

Despite the challenging economic landscape post-pandemic, the Glints job portal saw a significant jump in listings and matches (also taking into account the increasing popularity of the job portal, as well as its introduction in new markets). Glints observed a surge in demand for tech talent following the opening up of Southeast Asian markets — not just from startups, but also larger enterprises prioritizing digitization.

To elaborate on the potential of digitization towards enhancing tech jobs, we can take a closer look at the expectations in Southeast Asian markets. Indonesia, for example, seeks to create up to 45 million digital job vacancies. Malaysia’s digital vacancies tripled from 2020 to 2021, and continues on an upward trajectory. These involve opportunities from companies of all sizes and industries, both within and beyond the region.

“We’re seeing that a lot of companies from the US and China are now interested in expanding to SEA as well,” Yeo told Bloomberg in October, “and that adds to the demand and constraint of talent supply in the region.”

In line with the race towards digitization, IT technology and services emerged the top industry hiring in 2022. A total of 13% of all job postings came from this industry, far surpassing marketing and advertising (7%) and financial services (4%). This trend is likely to continue in 2023, with robust tech growth involving advanced data and wireless models; virtual and augmented reality; 3D printing, and Computing as a Service.

Employers in these spaces will therefore be looking for more niche and high-performing talent, perhaps even in more mature tech markets such as Singapore. In the context of a recession, the World Economic Forum anticipates more people to be working to secure their jobs. This will shift the power dynamic in the war for talent, once more placing the ball in the employer’s court.

Going granular, we see that software engineers were in highest demand this year, followed by business development and sales professionals. This trend is likely to continue next year, but the latter is likely to take a downturn next year, as sales and marketing operations are expected to be among the hardest hit. However, the opposite is true for engineers, who remain in high demand among leading tech roles – which also include data scientists, product managers, and UI/UX designers.

Further research on tech talent compensation corroborates the rise of tech roles, which received a base salary 37% higher than their tech-adjacent counterparts (in finance, administrative, sales, and marketing roles). Of the technical functions identified, engineering salaries are the highest in Singapore, Indonesia, and Vietnam – they increased 13% in 2022.

When asked about what will be their most prioritized function to hire, engineering was selected the most (79%), followed by business development & sales (59%) and product (45%). These functions also happen to be the most challenging to fill. Simply put, the tech talent crunch is still a real challenge among regional startups – especially when they have to compete with the reputation and resources of global companies.

What can employers do to manage this? For one, take this talent trend into account when building and restructuring roles and teams. When hiring for in-demand roles, employers should be prepared to offer higher salaries to compete against both local and international peer companies.

It is also worth enlisting the help of recruiters in the market you’re hiring in; their insights on local trends could just be the missing ingredient in your recipe for hiring.

Read Related Article : Southeast Asia Salary Guide 2020 [Ebook]

Since its pandemic-aided growth, remote hiring has become a mainstay in the tech startup space. It has allowed employers to tap into pools of specialized talent in Southeast Asia (SEA), supported by the shift to remote work in digital workspaces.

As Yeo explains “On one hand, comfort in remote hiring has increased because of the pandemic. On the other, there is this need to save costs. So from both a human capital angle and a financial capital angle, a lot of companies are now actually doing more remote hiring.

A Glints survey of regional startup founders shows that Singapore is the top destination for hiring remote talent across all functions. Malaysia is a rising market for tech roles in Southeast Asia, while the Philippines is pegged as a rising market for tech-adjacent roles.

Singapore is preferred for deep-tech specialist roles, mainly due to availability of senior talent and a more mature startup ecosystem. As for Malaysia, its tech talent pool’s high standards of education and English language proficiency are the main factors attracting foreign companies. It is a preferred destination for hiring remote engineers and data scientists.

As for tech-adjacent hiring – for which resources may continue to shrink in 2023 – employers may be looking at offshoring teams. The Philippines could be a top choice. The cost-efficiency of remote hiring will continue to be its main benefit, encouraging employers to look for talent where they may not have considered before. The Philippines has a pool of young, English-speaking graduates eager for careers in marketing, sales, or business development.

Surveying startup founders, it became apparent that certain roles are more eligible for cross-border hiring. Engineering came out on top once more, followed by product, then UI/UX research and design. This is due to a combination of factors, including the use of digital tools, level of independence in job scope, as well as universal skills required to do the job.

Like what you see? Subscribe to our newsletter to receive all our latest news and offers delivered right to your desk.

Beyond its benefits to employers, talent are also excited about the global possibilities afforded by remote hiring – particularly work flexibility and the opportunity to be exposed to new experiences. In fact, on average, 72% of tech talent in Singapore, Vietnam, and Indonesia are open to remote working for a company based overseas.

To gain a leg up over larger global companies, startups and smaller enterprises should amplify the inherent benefits of their environment — particularly opportunities for growth and career progression, autonomy, and strong culture.

With that being said, there are certain special workplace considerations to make when setting up remote teams. One tried-and-tested approach is building concentrated hubs in new markets. Yeo has witnessed how having entirely-remote operations scattered overseas disconnects them from the core of the business at the headquarters.

To avoid this, he recommends having small groups of people come into the local office a few times a week, effectively creating a hybrid balance which allows for both creativity and collaboration. “This allows you to tap onto different pools of talent, but ultimately there’s a local team that they’re working with everyday,” Yeo explains.

These hiring trends in 2022 show us that while circumstances may differ from a year ago, one thing is for sure: tech talent remains as essential – if not more so – to companies.

As employers explore alternative ways of hiring, expanding, and turning a profit, expect to see more changes in the modern work landscape:

Build your workforce from anywhere. Start your remote hiring journey with Glints.

This article is brought to you by Glints TalentHub. Leading companies are actively building their borderless teams in Southeast Asia, Taiwan, and beyond. However, the prospect of going borderless can be daunting due to complex regulations and cultural ambiguities. With Glints TalentHub, you’ll have a dedicated team of in-market legal, HR, and talent experts by your side at every step of the way.

Glints TalentHub offers an end-to-end, tech-enabled talent solution that encompasses talent acquisition, EOR, and talent development. We empower businesses to leverage the strengths of regional talent efficiently to build high-performing, cost-efficient teams.

Schedule a no-obligation consultation with our experts to receive a tailored proposal today.

Subscribe to our newsletter to receive all our latest news and offers delivered right to your desk.